In today’s restaurants, it’s not enough to scramble at the last minute to find all the available tax deductions. No matter which tax jurisdiction your restaurant or restaurants are in, there are common tax situations that careful tax planning can help to maximize your income and minimize your taxes. It’s important to determine which business form your restaurant will take because there are different tax situations for sole proprietorships, partnerships, corporations, S-corporations and other legal entities.

Common Tax Issues for Restaurants

One of the most useful tips for both restaurant startups and established culinary businesses is to plan an active tax strategy. Find useful deductions, tax credits and ways to defer taxes and build your business around those ideas.

You should discuss the relative tax advantages of different business models with a tax accountant and/or an attorney to choose the form that’s best for you. There are also some differences in your tax situation based on whether you run an independent restaurant or a franchise operation. General tips for business owners often focus on finding deductions for money they’ve already spent instead of finding the best investments that deliver tax breaks and advantages. That’s why working with a tax accountant is so important.

Common tax issues that most restaurant owners face include funding retirement plans, paying for health insurance, taking advantage of tax credits, keeping meticulous records, depreciating capital investments and getting the right insurance cover to protect their businesses. Successful restaurants and chain operations - no matter where they’re located - use proactive planning strategies to reduce their taxes, and you can do the same. Some of the common tax-saving strategies used by restaurants include:

-

Home Office Deductions

Most restaurants have an office on the premises where accounting, tax preparation and filing reports can be handled. However, many smaller restaurants might qualify for a home office deduction depending on their location’s tax code.

-

Startup Costs

These costs include planning, research and other expenses involved in establishing your business. Some areas might allow full deductions, but most jurisdictions require that these expenses be depreciated over time.

-

Employee Benefits

Most employee benefits are tax-deductible for employees, and employers can usually deduct any contributed that they make to health insurance, retirement plans and other programs.

-

Saving for Your Own Retirement

Most taxing authorities have tax-deductible or generally earn interest tax-free until retirees begin to withdraw funds. These retirement plans include IRAs and 401(k)s in the United States and other types of retirement plans in European countries, the UK and other countries. The retirement options also vary according to the form your business takes. Some types of corporations allow you to save money for yourself and your family members who are also employees. You can also prepare for retirement and other situations by getting insurance cover for various risks, setting up tax shelters for your family and using estate planning to minimize taxes on transferring funds to family members.

-

Spread the Wealth

You can compensate family members for direct work and consulting services in many cases. This gets complicated, so you should consult a local accountant or attorney to find out the local requirements.

-

Using Tax Credits

Many tax jurisdictions offer credits for hiring certain kinds of workers such as migrants, immigrants, minorities and disadvantaged young people. Other credits might be available for opening a business in decaying urban areas that are trying to rebuild, reducing energy usage and many others. This is a perfect example of how you can lower your tax bill with planning and proactive action.

-

Speeding and Slowing Payment

If you’ve had a great year, you might want to speed payments before the year’s end to lower your profit, reduce your taxes and strengthen your tax position for the upcoming year. The reverse is also true. If you’ve had a bad year and made little or no profit, you might try to delay making payments and encourage any creditors to pay their bills before the year ends. If you earn less, you’ll probably qualify for a lower tax rate.

Game-Changing Tax Reform

In the United States, restaurant taxes will be affected by Trump’s tax reform. That’s a common and ongoing problem for global restaurants. Just when you think you've got a handle on your tax situation, the rules change. That’s why it’s important to keep up with tax changes and make plans to deal with new tax rates, changes to how funds are deposited and increases or decreases in tax rates. Routine changes might include taking advantage of tax credits, expensing all your capital expenditures in the year you invest and changing your employee benefits packages.

Common Tax Mistakes

Many restaurateurs assume that every repair, capital expense and cost of remodeling are immediately deductible, but these items might be subject to depreciation over a period of years. You could make a big mistake if you’re audited and be is failing to estimate your taxes and make payments throughout the year. These are often due quarterly for smaller businesses, but the specifics depend on your tax authority.

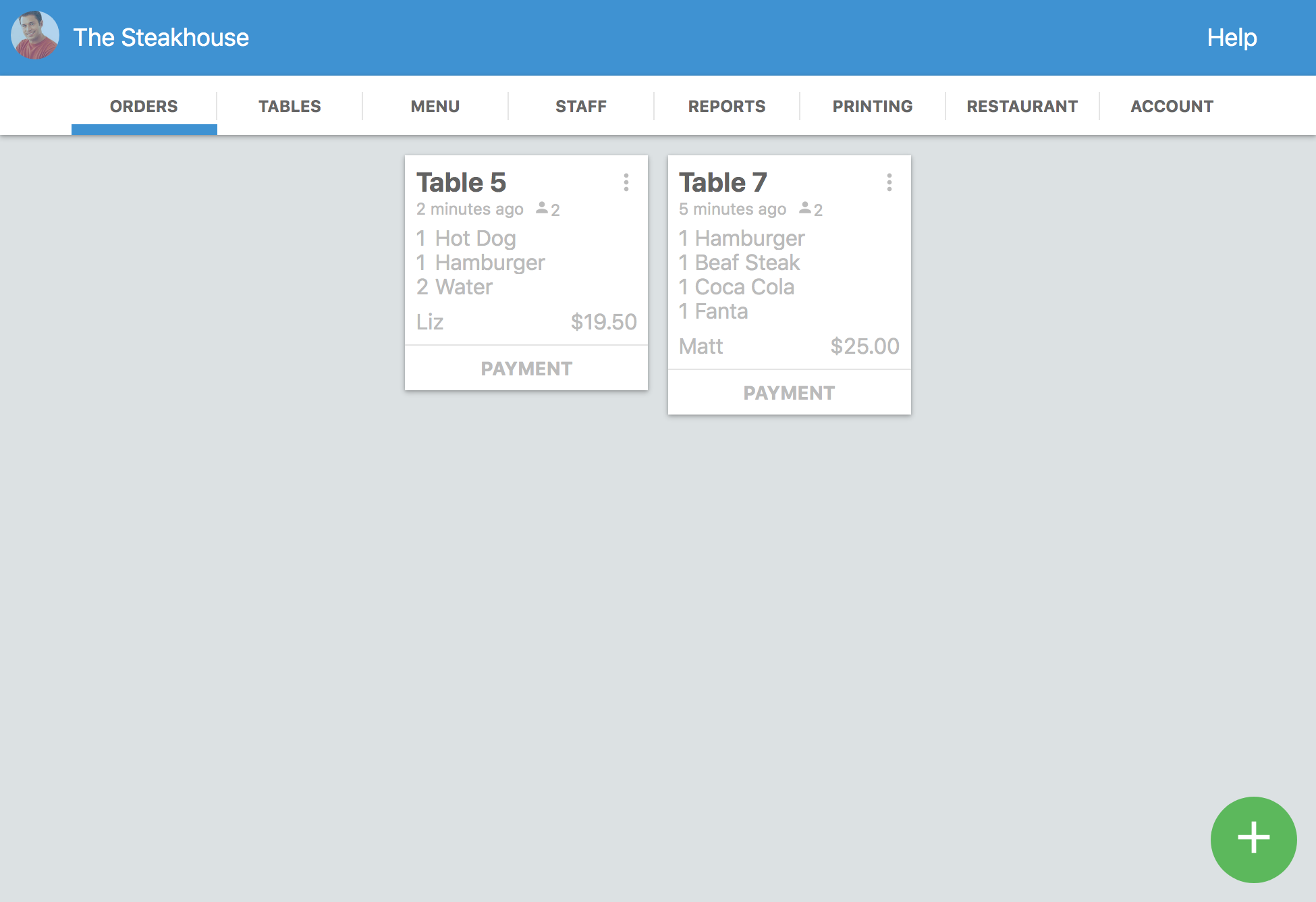

Another problem is collecting the right tax for federal, state, provincial and local taxes. Some jurisdictions feature meals tax, sales taxes on merchandise, VAT and other hospitality taxes. VAT tax is added to cost of goods, but other types of taxes need to be paid or deposited with the agency for which they’re collected within a certain time. That’s why it’s critical to keep meticulous records backed by your POS system, cash register tapes, spreadsheet computer program, accounting software or handwritten records.

Careful planning can prevent becoming frantic at tax time. Keep good records, consult an experienced accountant and/or attorney and use legal strategies to reduce your tax burden.