California Licenses and Permits for Restaurants, Bars and Food Trucks

You can cut through the red tape for getting a license for your restaurant, bar, or food truck in California with simple organization and planning. The first step is to determine where you’ll open your business. You’ll need a business license, but the costs of licenses vary, depending on which county or city issues the license.

You always have to check for local regulations and permits, but this article just covers the California licenses and permits you need. The calgold.ca.gov website is a good resource for finding information on the permits and licenses you need in different California counties.

The general state requirements for licensing restaurants include the following:

- Business license issued by the locality where you plan to operate your business

- Employer Identification Number (EIN)

- Health permit from the county where you operate

- California Seller’s Permit

- Fictitious Business Name

- Liquor License

1. Business License

The business license is issued by the city or county where you operate your restaurant, bar, or food truck. You have to check with the city to find out any additional requirements you need to fulfill to open your business. If the city has a small business development center, that’s a good place to visit for more complete information.

2. Employer Identification Number (EIN)

Your EIN is your federal identification number, which is used for all filings, reports, and tax withholding accounts for your employees. You also use the number to make estimated tax payments. It’s easy to file for an EIN, and there are no filing fees for getting your EIN, which is also called your tax ID number. You can apply for the number at irs.gov.

3. Health Permit

The process and costs of applying for a health permit to operate a bar, restaurant, or food truck in California vary, depending on local regulations. Each city has its own building code, fire department regulations, and police department guidelines, so a one-size-fits-all overview won’t work. You have to contact the local Department of Environmental Health. A great example is how the San Francisco County Health Department handles health permits.

In San Francisco County, health permits run from $904 to $1,365. Bar health permits cost $772 if the bar doesn’t serve food and bars that serve food pay $978 for their health permits. There are additional costs if you have to get an inspection and a new Certificate of Occupancy certificate after remodeling a building for your business. Similar costs are assessed by other health districts in California, but you need to check for the details.

Regardless of which California health district handles the health licensing for your restaurant, you will need to file an application, get your facility approved, and obtain food handler certification and food handler cards. According to cdph.ca.gov, there is a non-refundable $207 application fee to submit proposed changes when remodeling a facility for food service.

Food Safety Certifications in California

California requires that each restaurant’s owner, manager, or other designated staff member be held responsible for the safety of all food served on and off the premises. Third-party and health department-sponsored food manager training courses in California can prepare the designated food handler with information to pass the examination. You can find check the available courses and costs at www.cafoodmanagers.com. Prices range from $55 to $135.

Each employee and prospective employee of your bar, restaurant, or food truck must take a course and pass an exam to obtain a food handler card. You can find a list of ANSI-approved courses at ansi.org. New hires must obtain their cards within 30 days of their hire date. Food handler cards are valid for three years.

Getting a health permit in California can be relatively easy if you’re buying an existing restaurant or difficult if you remodel a building or don’t have restaurant experience or experienced staff.

4. California Seller’s Permit

The California seller’s permit is the official registration of your business with the state, which you need to do in addition to getting the local licenses. Registering your business with the state allows you to collect sales tax on your restaurant’s food, beverages, goods, and services, such as catering. You also use your seller’s ID number to buy food for resale without paying state sales tax and filing state income taxes and other reports.

You can apply for a seller’s license online, by phone at 800-400-7115, by mail, or in person at one of the state’s Board of Equalization offices. There is no fee for registering, but the state might require you to make a deposit against future taxes if you owe any back taxes. You can apply online for your Seller’s License at the www.cdtfa.ca.gov website.

.5. Fictitious Business Name

You have to register your restaurant, bar, or food truck name with the state in order to open a business bank account and be legally recognized in court as a legitimate business entity. You can register your Fictitious Business Name at businessportal.ca.gov.

You don’t have to register a fictitious name if you use your own legal name - such as O’Neil’s, Jerry Pasternak’s, or the last names used on a partnership. Lagasse and Puck wouldn't require filing for a Fictitious Business Name. Dewey, Chokum, and Howe would be perfect legal names for a restaurant run by three people with those last names, but they’re hopefully not descriptions of the customer experience. However, the crazy name might work for a restaurant targeting people with a wry sense of humor.

Using your name isn’t the best branding strategy for a new restaurant, unless you’re well known in culinary circles. Regardless of what fictitious name you choose, you must research the name to see if it’s already in use in the city or state. You can do that at the businessportal.ca.gov website. You also need to post a notice in the local newspaper for four consecutive weeks that you intend to trade under a fictitious name.

The cost of filing for a Fictitious Business Name in California is $26 for one name and one owner. Additional names and registrants (business partners) cost $5 each. These fees apply to sole proprietorships and partnerships. The license is good for five years, and you must file for renewal before the current license expires. You also have to pay for filing the notice in a local newspaper. You don’t have to file a Fictitious Business Name application for a corporation, but there are other registration details that will usually be handled by your incorporation attorney.

6. Mobile Food Facility Permit (Food Trucks Only)

Since food trucks are becoming more and more popular, some counties/localities require you to have a Mobile food facility permit. These permits generally state restrictions on hours of operations, specific locations, packaging, and most importantly- waste disposal.

The rules and process of application vary from city to city. A good way to find out what works for your own city or county is by Googling ‘ *Your county/city* Mobile Food Facility Permit Application’. Look for any ‘.gov’ or ‘.org’ website to find out what you need to do.

For example, Contra Costa - https://cchealth.org

7. Liquor Licenses in California

You’ll need to get the right kind of liquor license for your restaurant or bar, unless you’re planning to open a juice, coffee or tea bar. In California, you can’t serve alcohol from a food truck. There is a workaround - you can serve alcohol at a private location with food and beverages that are delivered by a truck.

According to liquorlicense.com, California offers five types of liquor licenses that are commonly used by businesses. These include:

- Type 47: On-premises sales of all types of liquor for restaurants

- Type 48: On-premises sales of all types of liquor for bars and nightclubs

- Type 20: Off-premises sales of beer and wine at convenience stores

- Type 21: Off-premises sales of all kinds of liquor for liquor stores and supermarkets

- Type 41: On-premises sales of all kinds of beer and wine

The Type 41 license is the least expensive for restaurants that just want to offer simple alcoholic beverages with meals. The cost is $650, and the application procedures vary in different counties throughout the state. Generally, you need to prove that you have all your permits, a proposed location and background information on all people owning a stake in the business. There also have to be new licenses available. Otherwise, you have to buy the license at market value.

The other licenses are more stringent, and they often require special approval from local governing bodies. You’ll have to determine the licensing requirements for the location where you plan to operate. There’s also another issue that complicates getting a liquor license in California. Some areas limit the number of liquor licenses available. In no state-issued licenses are available, you can only get one by buying the license on the open market from someone who is already licensed or a liquor license broker.

You can find out if liquor licenses are available where you plan to open a bar or restaurant and begin the application process at abc.ca.gov. The cost of the license varies, based on the county and license type. If there is a moratorium on licenses, you’ll be subject to market prices established by supply-and-demand factors.

As of the time this article was written, full liquor licenses ranged in price from $12,000 up to $400,000. Beer and wine licenses on the open market can range from $3,000 to $5,000. When you buy a license from a private seller, you must establish a legal transfer and set up an escrow account. It’s important to do your due diligence to determine whether an open market license has any legal restrictions.

Liquor licenses might seem to be more trouble than they’re worth, but an organized approach simplifies the process. Liquor sales in California bars and restaurants are very lucrative in a state where millionaires, actors, and celebrities are always looking for new restaurants, trendy food, and creative ambiance and design.

Special Instructions for Getting a California Bar License

There are special requirements for handling alcohol service. You could be held liable for serving alcohol to intoxicated customers. You also have to check customer ages on valid forms of identification. It’s a good idea to read the Q&A section published by abc.ca.gov to get a better idea about the specifics of managing alcohol service.

Special Instructions for Getting a California Food Truck License

You can’t apply for a business license or health permit online for a food truck in California. You must go to the city’s business office or small business development center and the local health department office to apply for the necessary permits. The food truck must be inspected for safety, and you have to get a mobile food license. The Quick Start Guide for mobile food vendors covers licensing and zoning issues, and you need permits for each county where you plan to operate your truck.

The basic licenses for food trucks are issued by the localities where they operate, which is beyond the scope of this article, but basic registration usually costs between $100 and $500. You also have to pay a percentage of your gross estimated income each year. Health permit licenses are covered in the Health Permit section.

You’ll also need an approved place to prepare and store food and clean and sanitize the truck. Food trucks must be parked at a certified food preparation facility when not in use. Your truck will receive periodic health inspections, and some districts require getting a permit for the fire department. You might need to present a Certificate of General Liability Insurance in some cities before final approval of your permits.

Keep a track of the California Licensing Process

There are many details involved in starting a restaurant, such as getting your restaurant listed online, and the best practice is to know what you need to do and making a step-by-step plan. Fortunately, you can handle most of the licensing process online, but things can get a little hairy if you’re remodeling your building and waiting for construction delays, inspections, and approvals.

You might have to wait to receive some of your permits, so make a timetable that takes all the deadlines and processing times into account. You’ll find that most jurisdictions have a pro-business attitude, and officials are available to answer your questions and help you.

Bonus Tip For Startups: Choose An Easy-To-Use POS System

Being in the food business myself, I have seen many food truck owners & restaurateurs struggling with their POS systems. Some systems are either too complicated or too expensive for entrepreneurs who are just starting out.

I would advise you to ask for a free trial of any POS system that you are considering to use. I would also discourage going with those POS systems which require you to invest in their special hardware. It’s not only expensive but also makes it hard for you to switch later on if you have any problem.

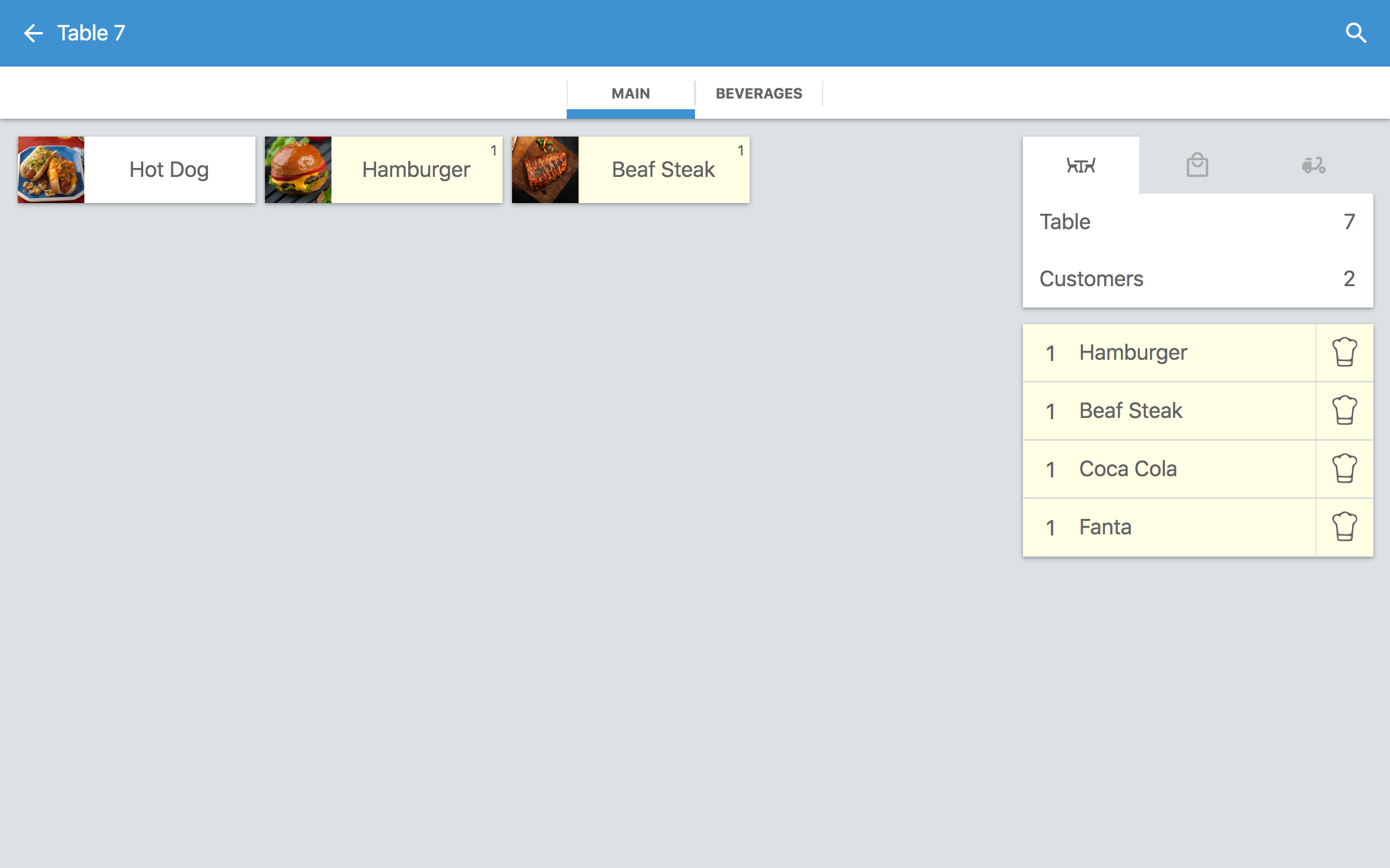

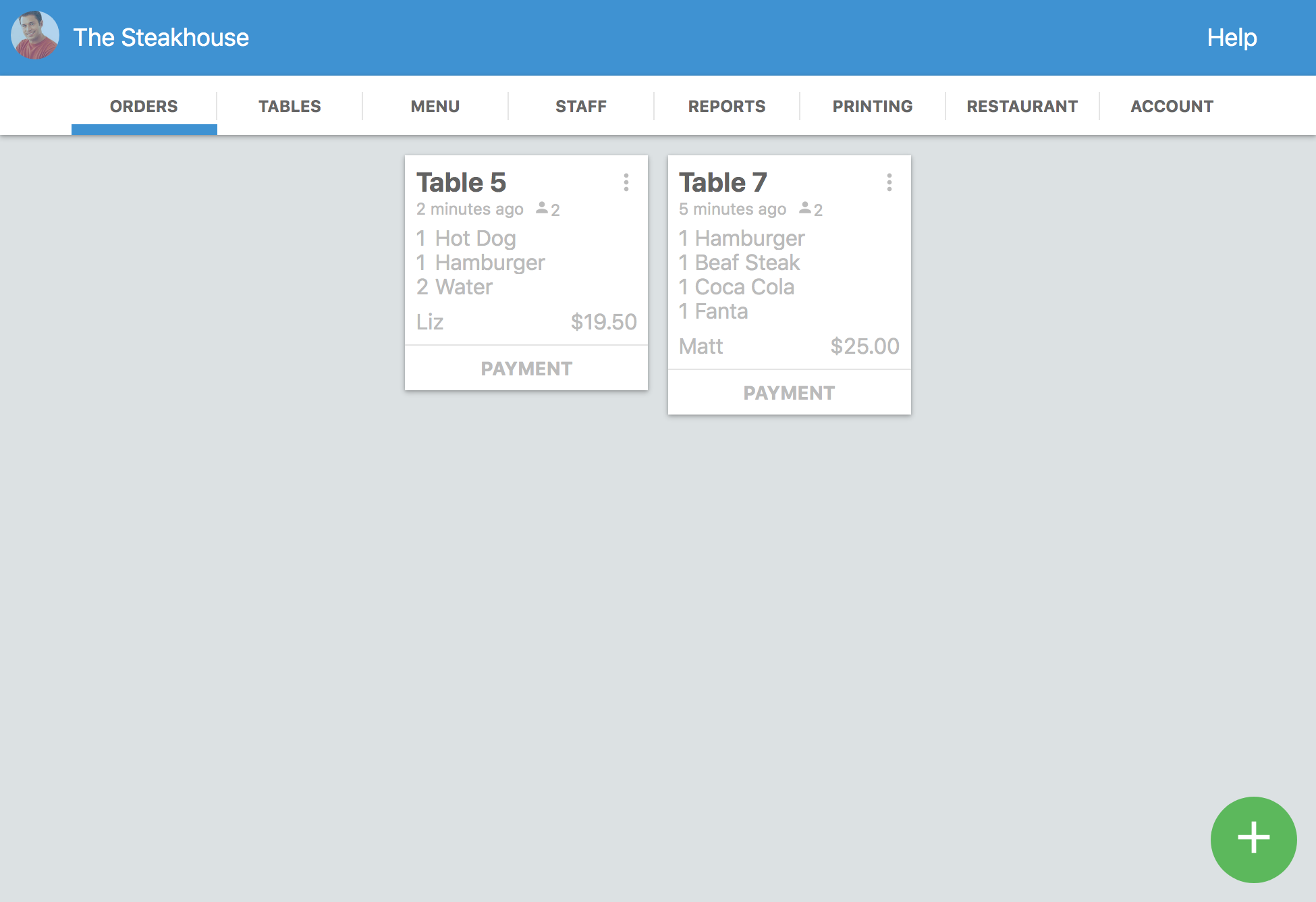

Fortunately, these days there are tons of POS software available that lets you run your food business from any normal iPad or even a smartphone!

If you still haven't decided on a POS system, I would recommend you try out Waiterio POS. You can check out our:

It’s fast, super-easy to use, and supported across any tablet or smartphone. Plus, we offer a free trial which is great for entrepreneurs who are just starting out.(Click here to download Waiterio POS for your business)